MIPLM 2018-19: 2nd module on decision theory and IP valuation

Decision theory is a framework of logical and mathematical concepts helping managers in formulating rules that lead to a most advantageous course of action, based on a strategy (MIPLM 1st Module) under given circumstances. This theoretical and interdisciplinary approach helps to determine how decisions are made given unknown variables and an uncertain environment. This is, what IP managers need to know for a “VUCA world” where we have to face various dimensions of an ‘uncontrollable’ environment. VUCA is an acronym and stands for Volatile, Uncertain, Complex and Ambiguous. These environmental conditions in many businesses have concrete consequences for management, especially for decision making in IP management. Decision theory brings psychology, statistics, philosophy and  mathematics together to analyze the decision-making process. Game theory, which explains social situations for example between competitors, is also discussed in this module. Game theory is a framework for social situations among competing players. It is the science of strategy and optimal decision making of independent and competing actors in a strategic setting.

mathematics together to analyze the decision-making process. Game theory, which explains social situations for example between competitors, is also discussed in this module. Game theory is a framework for social situations among competing players. It is the science of strategy and optimal decision making of independent and competing actors in a strategic setting.

The second part of this module is dedicated to understanding decision making and valuation. Companies create value through their operations. Managers consider operational excellence as a key ability to maximize firm value. But within the digital transformation, globalization, innovation and the ongoing war for talents the firm performance critically depends on a company’s ability to accurately determine its value and to asses the market impact of its IP. IP managers need valuation expertise to understand structured and systematic value creation by means of IP.

In our complex world, companies need to develop an understanding on how they create value for stakeholders and society at large, to be able to develop a long-term, viable strategy and to keep their license to operate. Value creation, however, is only partially captured by a company’s financial statements, since the latter mainly reflect its financial and manufactured capital. Other forms of capital, such as social, human, intellectual and natural capital, are only partially visible or not visible at all in a company’s financial accounts. Since these forms of capital often remain invisible, the question arises whether companies, and their stakeholders, have the right information base to make decisions and mitigate risks that could affect their overall value creation. Three quarters of the purchase price in M&A deals is represented by goodwill and intangible assets according to the 2017 Purchase Price Allocation Study from PPAnalyser. The report highlights the importance of identifying and measuring the value of intangible assets to support the rationale of an acquisition.

In our complex world, companies need to develop an understanding on how they create value for stakeholders and society at large, to be able to develop a long-term, viable strategy and to keep their license to operate. Value creation, however, is only partially captured by a company’s financial statements, since the latter mainly reflect its financial and manufactured capital. Other forms of capital, such as social, human, intellectual and natural capital, are only partially visible or not visible at all in a company’s financial accounts. Since these forms of capital often remain invisible, the question arises whether companies, and their stakeholders, have the right information base to make decisions and mitigate risks that could affect their overall value creation. Three quarters of the purchase price in M&A deals is represented by goodwill and intangible assets according to the 2017 Purchase Price Allocation Study from PPAnalyser. The report highlights the importance of identifying and measuring the value of intangible assets to support the rationale of an acquisition.

Intangibles – e.g. trading names, trademarks, brand names, patents, licenses, know-how, the author’s intellectual rights – can appear in all dimensions of business activity: distribution, financial services, sales and management. Usually, intangibles generate added value that exceeds the costs attributed to them and they cannot be replaced in a short time. Generally, the intangibles contribute to the growth of sales or the reduction of costs, and consequently they raise and enhance the value of the business.

Intangibles – e.g. trading names, trademarks, brand names, patents, licenses, know-how, the author’s intellectual rights – can appear in all dimensions of business activity: distribution, financial services, sales and management. Usually, intangibles generate added value that exceeds the costs attributed to them and they cannot be replaced in a short time. Generally, the intangibles contribute to the growth of sales or the reduction of costs, and consequently they raise and enhance the value of the business.

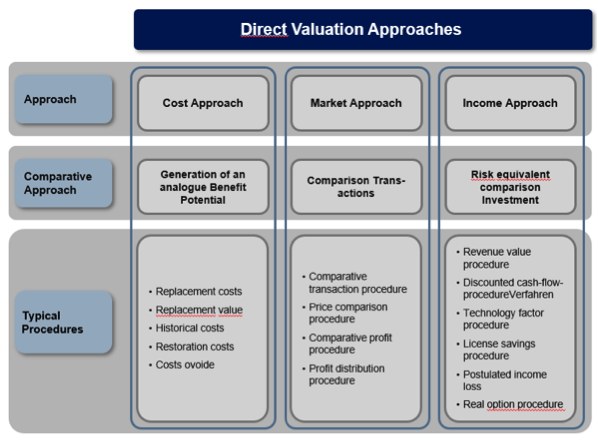

The valuation of intangibles exhibits many similarities to business appraisal. Three traditional approaches are used in the valuation of intangibles: income, cost and market. Due to the usual lack of market data, the valuation of intangibles is in most cases limited to two approaches: cost (sometimes limited by access to historical data) and income.

A general profile of the three universally accepted approaches to the appraisal of intangibles:

The market approach (comparative) – the value of intangibles is estimated based on comparable market transactions. As the intangibles are rather seldom sold separately from the enterprise itself and it is hard is to find comparable assets being traded on an active market, use of this method is possible in practice only in limited cases.

The cost approach – the value of intangibles is estimated as the cost necessary to produce the asset or replace it.

The income approach – the income approach takes into consideration potential revenues, expenses, profitability and investment expenditures related to the appraised intangible asset. This approach estimates the value of an intangible asset as the present value or capitalization of future cash flows, sales or saved costs over the period of the economic life of the intangible asset.

The income approach is perceived as the basic approach in the valuation of intangibles in the majority of cases. The income approach can take various methods depending on the unique character of the appraisal process of the intangible. The main income methods are as follows:

- Relief from royalty method

- Excess rate of return method

- Postulated loss of income method

- Discounted cash flow approach

Case study presentations:

Task 1:

Value Creation and Value Determination

Please explain how the value contribution of patents can be analyzed. Please describe the IP-based value generation in a fortress monopoly based on the example of pharmaceuticals. Please describe the IP-based value generation in a value-added monopoly based on the example of individualized functional yogurt. Please describe the IP-based value generation in a hub monopoly based on the example of telecommunication standards. Please describe the IP-based value generation in a monopoly in-a-box based on the example of Shimano.

Here you can follow the presentation to task 1

Presented by:

- Björn Möller, Siemens AG, Munich, Germany

- Christiane Marti, Novartis Pharma AG, Basel, Switzerland

- Martin Salzburger, Airbus Defence and Space GmbH, Manching, Germany

- Giulia Ubertone, Self-employed lawyer, Monza, Italy

- Neha Goel, Eaton India Innovation Center, Pune, India

- Plamena Giorgieva, EUIPO, Alicante, Spain

- Frederic Sahores, STMicroelectronics SA, Crolles, France

Task 2:

Analysis of the valuation context and the structure of the valuation model

Please explain the prerequisites of IP value creation. Please analyze the valuation context of the given case. Please analyze the valuation subject matter. Please describe the decision Bauma has to take in the specific case and choose a suitable valuation method. Please describe the objectification requirements and the source of the information to be considered. Please summarize the results of the analyzes carried out.

Here you can follow the presentation to task 2

Presented by:

- Kamran Houshang Pour Islam, IPI, Bern, Switzerland

- Oliver Feldhaus, ITEM Industrietechnik GmbH, Solingen, Germany

- Michael Kirklies, KIPAT Patentänwalt, Neu-Ulm, Germany

- Isabella Ferri, Solvay SA, Bollate, Italy

- Idoia Apraiz, Galbaian, Mondragon, Spain

- Vincent Chevroton, Faurecia Innenraum Systeme GmbH, Hagenbach, Germany

Task 3:

Value Determination

Please explain the valuation formula and which parameters have to be determined to assess the patent value. Please assess the patent portfolio’s useful life for the case on hand. Please assess the reference parameter(s). Please model the applicable royalty rate. Please assess the asset specific risk. Please explain the calculation of the patent value using the relief from royalty method.

Here you can follow the presentation to task 3

Presented by:

- Katsuya Iwazaki, Toyota Motor Corporation Ltd., Aichi, Japan

- James Eilertsen, Heptagon OY, Rueschlikon/Zurich, Switzerland

- Rabia Nurgul Ozbaylanli, Turkish Patent and Trademark Office, Ankara, Turkey

- Charles Roger, France Brevets SAS, Paris, France

- Roland Bittner, Siemens AG, Erlangen, Germany

- Andreas Weiland, Maschinenfabrik Rieter AG, Winterthur, Switzerland

- Hendrik Promies, Siemens AG, Erlangen, Germany