Start of the Certified University Course on “IP Valuation (I)” on 15th of June

The Certified University Course in “IP Valuation (I)” starts on 15th of June at the University of Strasbourg, CEIPI. The Course is provided through one of the most advanced distance learning platforms worldwide. Participants are flexible in their education. Learning without time pressure, as well as with a job and family are possible. From the consistent glossary to examples, the certificate provides a comprehensive perspective on every topic, but also an up to date overview on modern IP Management. The students benefit from a long-standing teaching practice in IP-Management which has been established at CEIPI since 2005. Information about the registration for this and other Certified University Courses can be found here.

Decision theory is a framework of logical and mathematical concepts helping managers in formulating rules that lead to a most advantageous course of action, based on a strategy under given circumstances. So, IP Valuation can be only meaningfully be used combined with a business strategy and also in a protective way to support the business strategy. This theoretical and interdisciplinary approach helps to determine how decisions are made given unknown variables and an uncertain environment. This is what IP managers need to know for a “VUCA world” where we have to face various dimensions of an ‘uncontrollable’ environment. VUCA is an acronym and stands for Volatile, Uncertain, Complex and Ambiguous. These environmental conditions in many businesses have concrete consequences for management, especially for decision making in IP management. Decision theory brings psychology, statistics, philosophy and mathematics together to analyze the decision-making process. Game theory, which explains social situations for example between competitors, is also discussed in this module. Game theory is a framework for social situations among competing players. It is the science of strategy and optimal decision making of independent and competing actors in a strategic setting.

Blind spots make it difficult to make smart decisions – challenge assumptions

With a basic understanding of decision-making IP valuation can be understood. Namely, companies create value through their operations. Managers consider operational excellence as a key ability to maximize firm value. But within the digital transformation, globalization, innovation and the ongoing war for talents the firm performance critically depends on a company’s ability to accurately determine its value and to assess the market impact of its IP. IP managers need valuation expertise to understand structured and systematic value creation by means of IP.

In our complex world, companies need to develop an understanding on how they create value for stakeholders and society at large, to be able to develop a long-term, viable strategy and to keep their license to operate. Value creation, however, is only partially captured by a company’s financial statements, since the latter mainly reflect its financial and manufactured capital. Other forms of capital, such as social, human, intellectual and natural capital, are only partially visible or not visible at all in a company’s financial accounts. Since these forms of capital often remain invisible, the question arises whether companies, and their stakeholders, have the right information base to make decisions and mitigate risks that could affect their overall value creation. Three quarters of the purchase price in M&A deals is represented by goodwill and intangible assets according to the 2017 Purchase Price Allocation Study from PPAnalyser. The report highlights the importance of identifying and measuring the value of intangible assets to support the rationale of an acquisition. With the introduction of always bigger IP portfolios and larger numbers of standard essential patents (SEPs), e.g. through the 5G standard, IP valuation in industry 4.0 and a global IP market becomes more and more important.

Intangibles – e.g. trading names, trademarks, brand names, patents, licenses, know-how, the author’s intellectual rights – can appear in all dimensions of business activity: distribution, financial services, sales and management. Usually, intangibles generate added value that exceeds the costs attributed to them and they cannot be replaced in a short time. Generally, the intangibles contribute to the growth of sales or the reduction of costs, and consequently they raise and enhance the value of the business.

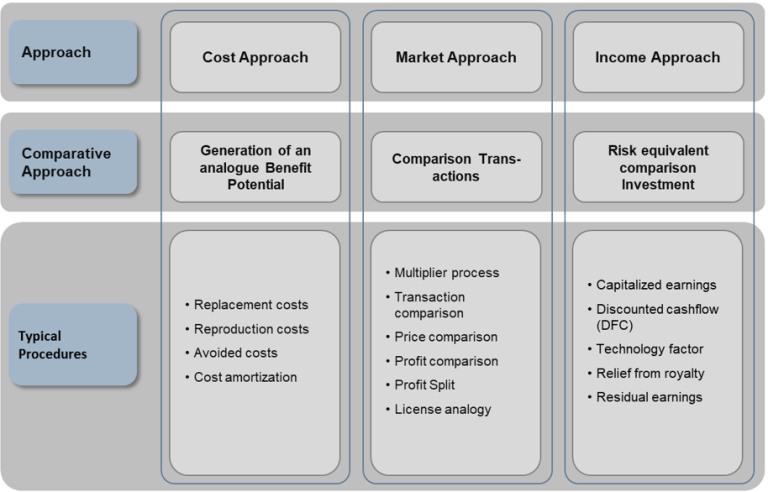

The valuation of intangibles exhibits many similarities to business appraisal. Three traditional approaches are used in the valuation of intangibles: income, cost and market. Due to the usual lack of market data, the valuation of intangibles is in most cases limited to two approaches: cost (sometimes limited by access to historical data) and income.

A general profile of the three universally accepted approaches to the appraisal of intangibles:

- The market approach (comparative) – the value of intangibles is estimated based on comparable market transactions. As the intangibles are rather seldom sold separately from the enterprise itself and it is hard is to find comparable assets being traded on an active market, use of this method is possible in practice only in limited cases.

- The cost approach – the value of intangibles is estimated as the cost necessary to produce the asset or replace it.

- The income approach – the income approach takes into consideration potential revenues, expenses, profitability and investment expenditures related to the appraised intangible asset. This approach estimates the value of an intangible asset as the present value or capitalization of future cash flows, sales or saved costs over the period of the economic life of the intangible asset.

The income approach is perceived as the basic approach in the valuation of intangibles in most cases. The income approach can take various methods depending on the unique character of the appraisal process of the intangible. The main income methods are as follows:

- Relief from royalty method

- Excess rate of return method

- Postulated loss of income method

- Discounted cash flow approach

The university certificates on IP valuation comprises issues like:

- Systematic valuation to secure an IP strategy

- IP valuation & Determining appropriate royalty rates

- Inside the global IP market

- IP valuation in the fourth industrial revolution

- IP negotiation class

- FRAND/SEP licensing in different industries