What the new market data means for competition, expert branding, and digital business development in German patent practice

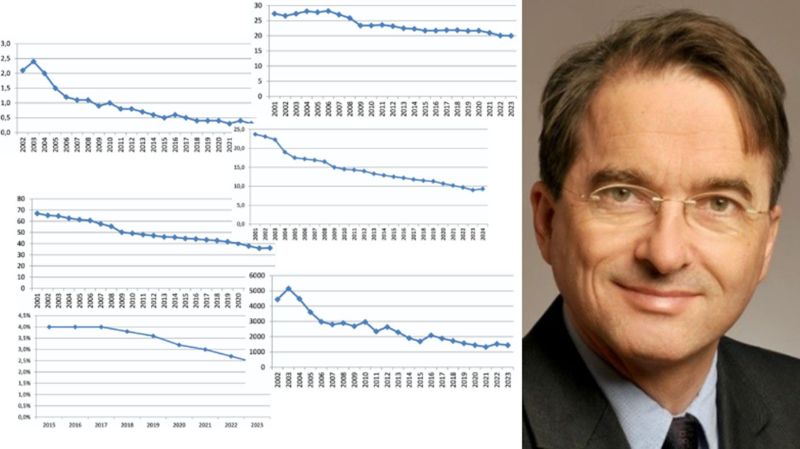

The latest statistical portrait of Germany’s patent-attorney market is sobering — and clarifying. Supply has expanded far faster than the demand indicators most firms rely on. From 2001 to 2024, the number of German patent attorneys grew by roughly 115%, while domestic patent filings fell about 13% and utility models by 52%. Contested proceedings have dropped sharply as well. Meanwhile, European filings expanded overall, but German representatives captured that growth only under-proportionally. Layer on an accelerating wave of AI-enabled automation, and the competitive picture comes into focus: capacity is up, classic volume pools are flat or shrinking, and routine work is under pressure.

This is a post about the paper: Köllner, M.; Meitinger, T.H.: Some figures on the market for patent attorney services in Germany, Mitteilungen der deutschen Patentanwälte, 116/10 (2025) 425-436

This post translates those findings into practical consequences for competition, expert branding, and digital business development — especially for patent attorneys who want to stay essential, visible, and commercially successful.

The competitive reality: a structurally tighter market

Three dynamics reshape day-to-day competition:

- More attorneys, fewer “easy” matters per head. The ratio of German patent applications (from German applicants) per attorney fell from ~23.7 to ~9.3 between 2001 and 2024 — a decline of about 61%. Even that ratio is an upper bound, because in-house patent engineers and non-patent-attorney drafters are counted on the filings side. In short: there are materially fewer new domestic applications available per attorney than two decades ago.

- Litigation scarcity. New contentious German matters per attorney sank from ~2.1 to ~0.3 between 2002 and 2023 — an ~86% The pipeline of oppositions and appeals has thinned, and the “everyday” litigation exposure of a generalist practice is not what it used to be.

- European growth without proportionate share. While total EPO filings rose ~95% (2001–2023), those handled by German representatives increased by ~56%; on a per-attorney basis, that’s ~27% down over the period. German practices benefit from Europe, but not at the pace of the overall market’s expansion.

Add two more structural features:

- Client concentration remains real. Around a quarter to nearly half of domestic filings trace back to the top 10–50 filers — many from the automotive ecosystem — which often self-prepare or maintain deep, longstanding relationships. Winning share here requires more than capacity; it requires category expertise and demonstrable strategic value.

- In-house capability has matured. By end-2025, ~494 admitted Syndikuspatentanwälte represented about 11.6% of the profession, up from zero before the 2015 legal change — another signal that drafting and portfolio hygiene increasingly sit closer to the business.

The implication is simple: volume-only positioning is a race to the bottom. The winning position is to be the expert who shapes outcomes where filings meet business strategy, across technologies and markets.

Expert branding: if the menu commoditizes, brand the chef

When baseline drafting capacity is abundant and automation rises, who you are becomes as important as what you do. “Expert branding” is not vanity; it is a revenue strategy built on clear market signals that de-risk a client’s choice.

Five moves to stand out:

- Own a problem space, not a label. “European patent attorney” is a credential, not a market position. “Safety-critical embedded systems for automotive and industrial controls” is a position — anchored in the problems engineers, product managers, and legal heads actually have. Your website, talks, and examples should thread through that problem space consistently. (Large portions of the filing base remain auto-adjacent; speaking the language of that value chain matters.)

- Show your method. Publish your repeatable approach to invention harvesting, claim pattern libraries for recurrent architectures, risk triage for AI-assisted drafting, and reusability guidelines for modular portfolios. Methods turn intangible expertise into visible, comparable value — precisely when routine work faces automation. (The study itself flags an AI-automation wave set to reshape the profession.)

- Translate IP to business outcomes. Map filings to line-of-business objectives: market entry timing, interoperability gating, switching-costs design, and cost-of-delay. Case notes that link a portfolio decision to a commercial effect will outperform generic “quality” claims every time.

- Earn trust in the right arenas. Publish in sector-specific venues, participate in engineering meetups, and guest on podcasts your buyers already consume. Visibility in their channels beats awards in our channels.

- Make it easy to test you. Offer tight, outcome-scoped entry products: a “FTO sprint” for a single product line; a “portfolio to product-map” workshop; or a “standards-readiness check” for connectivity features. Experts who can be sampled are easier to hire.

Remember: trademarks and designs remain viable adjuncts (German trademarks up ~18% since 2001; EU trademarks with German applicants up ~128% since 2001; community designs up ~55% since 2003 but flattening lately). If you sit at the intersection of brand, UX, and product, folding these rights into your story can enlarge the stage you play on.

Digital business development: build a system, not sporadic campaigns

In a tighter market, digital has to do more than “announce wins.” It must consistently create conversations with the exact people who feel the problems you solve.

A practical system for patent attorneys:

- ICP & use-case clarity. Document your ideal client profiles — technology stack, regulatory context, release cadence — and the 3–5 recurring moments when they most need you (e.g., pre-Series B portfolio clean-up; post-merger integration of invention capture; standards-body acceleration).

- Signature content with compounding value.

- Monthly “engineering-first” briefs that explain claim patterns against real architectures (e.g., sensor fusion pipelines, OTA update mechanisms).

- Short deconstructions of EPO BoA outcomes relevant to your niche, tied to practical drafting implications.

- A rolling knowledge asset: glossaries, checklists, or decision trees that your audience bookmarks and teams adopt.

- Offers that match digital intent. Pair content with context-specific offers: after an article on modular battery systems, a 90-minute concept-to-claim review for one feature; after a standards update, a 10-day readiness sprint for a product team.

- Conversion plumbing that works. Dedicated landing pages with single next steps, calendar booking within two clicks, and UTM-tagged links so you learn which topics, channels, and formats actually create qualified conversations.

- Rhythm and accountability. A weekly cadence on LinkedIn (where your buyers already are), a monthly long-form piece that anchors SEO and newsletter topics, and a quarterly webinar or live case clinic. Measure first meetings booked and time to first paid engagement as the two north-star metrics.

- Augment with AI, keep quality human. Use AI to outline, summarize case law, and generate first-pass structures — but keep final drafting, examples, and heuristics distinctly yours. The study’s automation note is a nudge to elevate what only experts can add: judgment, context, and patterns learned from real projects.

Service design and pricing: productize outcomes, reduce friction

As routine units get squeezed, productized services aligned to outcomes create margin and momentum:

- Entry products (fixed price): invention harvesting workshop for one squad; express FTO on a single release train; “portfolio debt” clean-up for legacy claims.

- Core products (subscription/retainer): rolling “product-to-portfolio” synchronization with quarterly claim refresh; standards-tracking with rapid opposition triage; competitor activity radar with strategic filing triggers.

- Strategic products (higher-touch): market-entry IP playbooks, licensing readiness, or litigation posture audits that integrate economic analysis.

Each product should clearly state scope, deliverables, turnaround, and business effect. This reduces procurement friction and lets you compete on clarity instead of hours.

Where competition goes next — and how to get ahead of it

Given the numbers, expect four trends:

- Polarization between volume shops and expert boutiques. Volume players will lean into tooling, templates, and economies of scale. Expert boutiques will win on problem depth, industry context, and decision-grade advice. The middle thins out. (That thinning is already visible in per-attorney workload ratios.)

- In-house/firm collaboration models mature. With more Syndikuspatentanwälte, hybrid workflows multiply: firms that plug into product squads, run targeted sprints, and hand off artifacts that in-house teams extend will be preferred partners.

- Opposition and litigation become episodic and premium. As contentious matters per attorney stay scarce, those who specialize in high-stakes proceedings, with demonstrable win-patterns in specific technologies, will command premium pricing. (EPO opposition shares and absolute numbers show a downward trend over recent years.)

- Design and brand as “edges.” Even as German design filings declined ~57% since 2001, EU-level brand/design activity remains meaningful; firms that articulate a product experience–centric IP story — utility + design + brand — can open doors beyond classic prosecution.

Bottom line: The data confirms a market where capacity is abundant, routine volume is contested, and contested work is rarer. That is not a crisis — it is a sorting mechanism. Patent attorneys who claim a problem space, show their method, and run a digital system that reliably creates qualified conversations will not only endure; they will shape how innovative companies use IP to compete. The rest will fight over a shrinking pool of undifferentiated tasks. The choice is strategic — and it starts now.