Value driven IP strategies, Digital business eco-systems, Innovation management, Monetization of IP, Innovator’s dilemma: 🎯 IP Management Pulse #7

Many IP experts in the IP community at I3PM, the HTB-EPO initiative, and other global IP offices and institutions in national and regional innovation systems have asked Prof. Alexander Wurzer: “where can you be sure not to miss any important IP management content”. In fact, you have to follow a number of interesting feeds to really keep up with the global developments around IP management. To make this easier he decided to offer his own personal newsletter for IP management. Here you can find the last issues in the archive and also subscribe. A fresh read with all the important IP Management content will be sent to the subscribers every second Thursday at 7.00 (CET), so you can start your day informed.

The next Newsletter will cover the following topics:

Value driven IP strategies

Is 𝐯𝐚𝐥𝐮𝐞-𝐝𝐫𝐢𝐯𝐞𝐧 the opposite of 𝐢𝐧𝐯𝐞𝐧𝐭𝐢𝐨𝐧-𝐝𝐫𝐢𝐯𝐞𝐧 🤔? And what does this difference have to do with the profession of patent attorneys 😲? Read it from Beat Weibel!

Is 𝐯𝐚𝐥𝐮𝐞-𝐝𝐫𝐢𝐯𝐞𝐧 the opposite of 𝐢𝐧𝐯𝐞𝐧𝐭𝐢𝐨𝐧-𝐝𝐫𝐢𝐯𝐞𝐧 🤔? And what does this difference have to do with the profession of patent attorneys 😲? Read it from Beat Weibel!

“𝑰𝒏 𝒑𝒂𝒓𝒕𝒊𝒄𝒖𝒍𝒂𝒓, 𝒕𝒉𝒂𝒕 𝒂𝒍𝒔𝒐 𝒎𝒆𝒂𝒏𝒔 𝒕𝒉𝒂𝒕 𝒊𝒏 𝒕𝒉𝒆 𝒇𝒖𝒕𝒖𝒓𝒆, 𝒑𝒂𝒕𝒆𝒏𝒕 𝒂𝒕𝒕𝒐𝒓𝒏𝒆𝒚𝒔 𝒘𝒊𝒍𝒍 𝒏𝒆𝒆𝒅 𝒕𝒐 𝒃𝒆 𝒒𝒖𝒊𝒕𝒆 𝒇𝒂𝒎𝒊𝒍𝒊𝒂𝒓 𝒘𝒊𝒕𝒉 𝒕𝒉𝒆 𝒄𝒐𝒎𝒑𝒂𝒏𝒚’𝒔 𝒔𝒕𝒓𝒂𝒕𝒆𝒈𝒚, 𝒂𝒔 𝒘𝒆𝒍𝒍 𝒂𝒔 𝒊𝒕𝒔 𝒎𝒂𝒓𝒌𝒆𝒕, 𝒕𝒆𝒄𝒉𝒏𝒐𝒍𝒐𝒈𝒚 𝒂𝒏𝒅 𝒄𝒐𝒎𝒑𝒆𝒕𝒊𝒕𝒊𝒗𝒆 𝒆𝒏𝒗𝒊𝒓𝒐𝒏𝒎𝒆𝒏𝒕, 𝒂𝒏𝒅 𝒎𝒖𝒔𝒕 𝒃𝒆 𝒂𝒃𝒍𝒆 𝒕𝒐 𝒔𝒑𝒆𝒂𝒌 𝒕𝒉𝒆 𝒔𝒂𝒎𝒆 “𝒍𝒂𝒏𝒈𝒖𝒂𝒈𝒆” 𝒂𝒔 𝒕𝒉𝒆 𝒔𝒕𝒓𝒂𝒕𝒆𝒈𝒚, 𝒑𝒓𝒐𝒅𝒖𝒄𝒕 𝒎𝒂𝒏𝒂𝒈𝒆𝒎𝒆𝒏𝒕, 𝒅𝒆𝒗𝒆𝒍𝒐𝒑𝒎𝒆𝒏𝒕 𝒂𝒏𝒅 𝒑𝒓𝒐𝒅𝒖𝒄𝒕𝒊𝒐𝒏 𝒅𝒆𝒑𝒂𝒓𝒕𝒎𝒆𝒏𝒕𝒔.”

Digital business eco-systems

Why is Lego such a good example for learning about IP 🧐?

Why is Lego such a good example for learning about IP 🧐?

With Lego, children (and adults!) can let their imagination run wild and build anything they can imagine. There are no limits to what you can build with Lego, from simple buildings to complex machines and works of art.

Innovation management

What is probably the most difficult individual discipline in the innovation competition 🤔? Exactly: 𝐚𝐛𝐚𝐧𝐝𝐨𝐧 𝐚 𝐩𝐫𝐨𝐣𝐞𝐜𝐭 😩! You can see this with the 𝐀𝐩𝐩𝐥𝐞 𝐢𝐂𝐚𝐫.

What is probably the most difficult individual discipline in the innovation competition 🤔? Exactly: 𝐚𝐛𝐚𝐧𝐝𝐨𝐧 𝐚 𝐩𝐫𝐨𝐣𝐞𝐜𝐭 😩! You can see this with the 𝐀𝐩𝐩𝐥𝐞 𝐢𝐂𝐚𝐫.

Thousands of employees are said to have been working on an autonomous electric car at Apple for over ten years: Project Titan. The project is now being completed and 𝐭𝐡𝐞 𝐞𝐧𝐭𝐢𝐫𝐞 𝐭𝐞𝐚𝐦 𝐰𝐢𝐥𝐥 𝐟𝐨𝐜𝐮𝐬 𝐨𝐧 𝐠𝐞𝐧𝐞𝐫𝐚𝐭𝐢𝐯𝐞 𝐀𝐈 👀.

Monetization of IP

𝐖𝐡𝐨 𝐚𝐫𝐞 𝐭𝐡𝐞 𝐜𝐡𝐚𝐦𝐩𝐢𝐨𝐧𝐬 🤔? Well 𝐐𝐮𝐞𝐞𝐧 – of course. A really strong brand that has always made money is now being sold 😮.

𝐖𝐡𝐨 𝐚𝐫𝐞 𝐭𝐡𝐞 𝐜𝐡𝐚𝐦𝐩𝐢𝐨𝐧𝐬 🤔? Well 𝐐𝐮𝐞𝐞𝐧 – of course. A really strong brand that has always made money is now being sold 😮.

The band Queen’s music catalogue is now for sale and shows how valuable intangible goods and property are. The music assets include music recordings, publishing rights and ancillary income. These additional revenue streams also include revenue from the film “Bohemian Rhapsody”, merchandise and other licensing opportunities totalling US$1.2 billion.

Innovator’s dilemma

What is a 𝐊𝐨𝐝𝐚𝐤 𝐌𝐨𝐦𝐞𝐧𝐭 🤔? Great or bad? It depends on what meaning is meant: the latter will soon affect many companies – 𝐊𝐨𝐝𝐚𝐤 𝐢𝐬 𝐧𝐨𝐭 𝐚𝐧 𝐢𝐬𝐨𝐥𝐚𝐭𝐞𝐝 𝐜𝐚𝐬𝐞 😨.

What is a 𝐊𝐨𝐝𝐚𝐤 𝐌𝐨𝐦𝐞𝐧𝐭 🤔? Great or bad? It depends on what meaning is meant: the latter will soon affect many companies – 𝐊𝐨𝐝𝐚𝐤 𝐢𝐬 𝐧𝐨𝐭 𝐚𝐧 𝐢𝐬𝐨𝐥𝐚𝐭𝐞𝐝 𝐜𝐚𝐬𝐞 😨.

The current mix of AI dynamics, AR/VR metaverse access and Web3 logic is highly explosive for existing business models. 📢 𝐈 𝐡𝐞𝐚𝐫 𝐢𝐧 𝐚𝐥𝐦𝐨𝐬𝐭 𝐞𝐯𝐞𝐫𝐲 𝐰𝐨𝐫𝐤𝐬𝐡𝐨𝐩 “𝐰𝐞’𝐫𝐞 𝐧𝐨𝐭 𝐭𝐡𝐞𝐫𝐞 𝐲𝐞𝐭”. 𝐓𝐡𝐞 𝐩𝐫𝐨𝐛𝐥𝐞𝐦 𝐢𝐬: 𝐧𝐨𝐛𝐨𝐝𝐲 𝐰𝐚𝐢𝐭𝐬! 𝐀𝐧𝐝 𝐈𝐏 𝐝𝐞𝐬𝐜𝐫𝐢𝐛𝐞𝐬 𝐭𝐡𝐞 𝐟𝐮𝐭𝐮𝐫𝐞 – 𝐭𝐡𝐢𝐧𝐤 𝐚𝐛𝐨𝐮𝐭 𝐲𝐨𝐮𝐫 𝐟𝐮𝐭𝐮𝐫𝐞 𝐚𝐧𝐝 𝐩𝐫𝐞𝐩𝐚𝐫𝐞 𝐲𝐨𝐮𝐫 𝐈𝐏 𝐩𝐨𝐫𝐭𝐟𝐨𝐥𝐢𝐨 𝐟𝐨𝐫 𝐢𝐭!

Whom to follow

Osvaldo Amaral informs you on his LinkedIn feed about the latest developments in aviation in relation to flying cars, aeroplanes, rocket and satellite technologies. The reported developments come from both the civilian and military sectors. He also provides insights into the international IP perspective, e.g. with comparisons between IP activities in the USA and China.

Joe Doyle‘s LinkedIn feed keeps you up to date with the latest webinars and other resources for European SMEs and business decision makers to raise awareness of intellectual property. He does this from an Irish and European perspective. He also provides information on how intellectual property can be utilised for sustainable growth and in digital environments.

Registration of Unconventional “Smell” trademarks

UAE Trademarks law has widened the definition of “trademarks” to include smell marks within its fold though it is yet to grant registration to any such unconventional mark. Although we have seen that there are some smell marks which have been accorded registrations in other jurisdictions, the requisitions to attain its registration under any trademarks law are hard to meet. The foremost requisition for attaining such a registration is the ability to describe smell as accurately as one can bringing out the real fragrance/s involved. Further, there should not exist any connection between the product bearing a smell and its functionality per se.

Beyond the Share Button: SMEs and the Intricacies of Copyright on Social Media

Social media presents a golden opportunity for small and medium-sized enterprises (SMEs) to expand their reach, connect with customers, and showcase their products and services. However, this vibrant online landscape also presents certain challenges and risks, particularly regarding intellectual property rights (IPR).

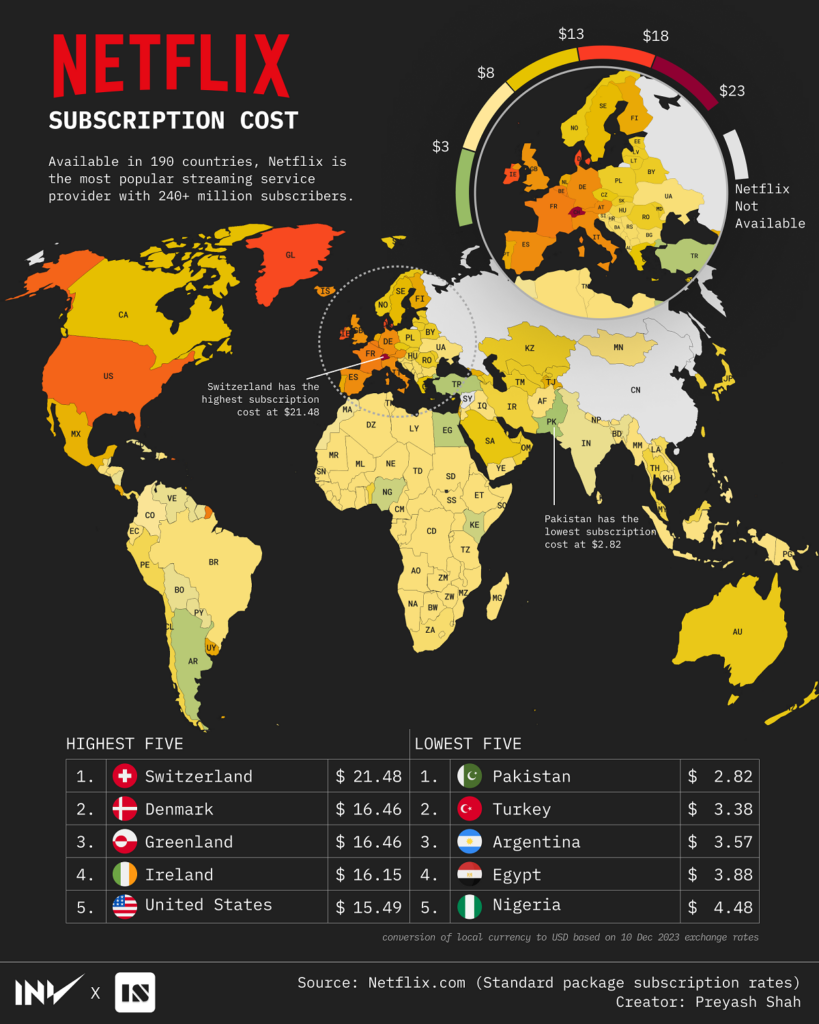

How do streaming services protect their business models with IP?

The growing fondness towards streaming services like Netflix, Hulu, Amazon Prime, and others can have a tremendous impact on the market growth in the forthcoming years. It is therefore not surprising that the major providers protect the various user experiences of their platforms with patents in order to gain market share and customer loyalty. The research project of Rudina Ann Pescante entitled “Exploring the Business Models of Netflix and Disney+, their Customer-Drawing Businesses, Patent Strategies, and Platforms, and the Business Growth Challenges They Face Over the Years” examines the digital patenting strategies of Netflix and Disney+, their digital business models, and the business growth challenges they face over the years, and how they address these challenges to achieve who they are today.

IP valuation: The income approach

Compared to the cost and market approach, the valuation based on the income approach most directly utilizes the definition of the IP value in terms of the expected future benefit for the IP holder. The return is the sum of the benefits that the IP owner can expect from his IP over the utilization period. The income from the IP right to be valued must be compared with the optimum alternative investment. The net value corresponds to the price of the alternative investment.