MIPLM 2017-18 2nd module about valuation and case study presentations

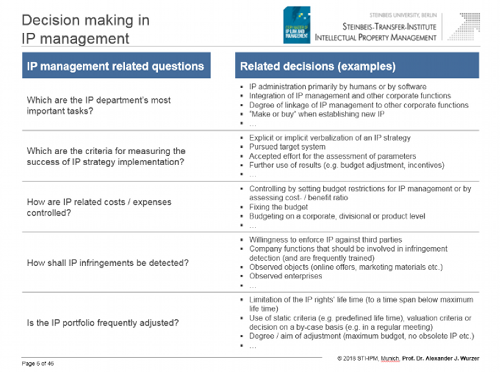

MIPLM program proceeds in February 2018 with the 2nd module about decision making and valuation. Decision making is a key challenge for IP managers and so the course is dedicated to understand the structure of business and IP management problems and the aspects of involved decisions. Understand the decision framework und the tools for decision making. Typical complex IP management decisions along the innovation process are analyzed and decomposed to understand the what determines business decision under given premises and prerequisites. Decision analysis offers the possibility to decision maker of replacing confusion by clear insight into a desired course of action.

The second part of this module at the MIPLM is about valuation. Key aspects are the understanding of the concept of value, understanding of the context dependence of valuation, understanding for different valuation methods and acquiring practical valuation skills.

The second part of this module at the MIPLM is about valuation. Key aspects are the understanding of the concept of value, understanding of the context dependence of valuation, understanding for different valuation methods and acquiring practical valuation skills.

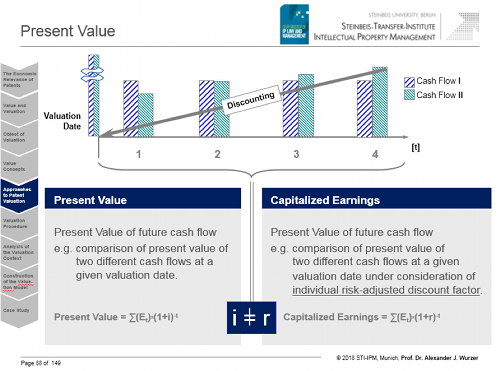

Value is defined as the sum of future benefits, discounted to a net present value. Whereas prices refer to the exchange value of an asset expressed in monetary terms and costs refer to the consumption of economic assets (tangible or intangible) in the production and sale of goods and/or services.

Based on different case studies, students learn to apply valuation models and methods. They learn to determine net present values of future cash flows and the comparison of present value of two different cash flows at a given valuation date. Furthermore they learn the determination of net present values under consideration of individual risk-adjusted discount factors. Different direct valuation approaches like cost approach, market approach and income approach are discussed.

Based on different case studies, students learn to apply valuation models and methods. They learn to determine net present values of future cash flows and the comparison of present value of two different cash flows at a given valuation date. Furthermore they learn the determination of net present values under consideration of individual risk-adjusted discount factors. Different direct valuation approaches like cost approach, market approach and income approach are discussed.

Case Study Patent and company valuation

Analysis of the valuation context and the structure of the valuation model

- Set up

Schneider GmbH & Co. KG headquartered in Münster is a small start-up company specializing in the development, manufacturing and distribution of machines used in trenchless pipe laying processes. By means of this technology pipelines for gas, electricity, telekommunication etc. are layed without digging a trench. Hence this technology excels when installing or maintaining pipes in densely populated areas. Roads are not impacted, particularly, traffic is not interrupted. Compared to traditional methods cost efficiencies can be obtained. Another field of application is pipe laying beneath environmentally sensitive areas as biotopes are only marginally impacted. In so far it is an environmentally friendly technology.

Schneider GmbH & Co. KG headquartered in Münster is a small start-up company specializing in the development, manufacturing and distribution of machines used in trenchless pipe laying processes. By means of this technology pipelines for gas, electricity, telekommunication etc. are layed without digging a trench. Hence this technology excels when installing or maintaining pipes in densely populated areas. Roads are not impacted, particularly, traffic is not interrupted. Compared to traditional methods cost efficiencies can be obtained. Another field of application is pipe laying beneath environmentally sensitive areas as biotopes are only marginally impacted. In so far it is an environmentally friendly technology.

One of the great challenges of any pipe laying technique is the precise drilling of the line route. Schneider GmbH & Co. KG developed an innovative system of horizontal drilling devices and methods in addition to the required machines and components. In a first step the direction of the line route is planned and the line route is scanned for obstacles. At the starting and endpoints boreholes are drilled. A pilot drilling towards the end borehole is performed. The drilling head is flexible and can be steered. In general, the drilling is done at an angle, and led in a curved path to the endpoint. During the drilling a special suspension is pumped to the drilling head, and released from its top. The suspension removes the soil and small stones, rinses out dissolved materials, and stabilizes the line route. In case of drilling in geological difficult terrain, a special vibration apparatus can be installed.

In a second step the drilling head is removed, and the pipe is attached to the drilling rod, and pulled through the line route. In the event that the diameter of the pipes exceeds the diameter of the drilling hole, an expansion head is attached to enlarge the borehole and extend the diameter.

The technology developed by Schneider GmbH & Co. KG is unique in terms of quality and precision. To secure the technological advantage, Schneider Management decided on legally protecting, particularly, the main components of the horizontal drilling machine (“HDM”). During the past five years (2000 to 2004) company has filed the following patents: ….

Schneider Management also decided to file patents in foreign jurisdictions, particularly, in those European countries where the company’s main competitors operate. Presumably, not only substantial components of the machines are protected by patents included in the company’s patent portfolio but also the processes involved in the services provided primarily by means of these machines. Schneider Management believes that due to the existence of these patents no competitor has been able to develop devices of the same quality and precision despite the high demand of horizontal drilling machines.

Schneider GmbH & Co. KG is funded by venture capital. While groundbreaking pilot projects were succesfully started using the HDMs the company has not been capable of building a strong distribution network. As a result revenues were below expectations in the past, and to limit its risk exposure of his investment the investor plans an exit in 2008. As the managing shareholder does not expect to obtain financing from another source, he agreed to the disposal of the shares in the company. Manufacturers of construction equipment were readily identified as potential buyers given Schneider GmbH & Co. KG’s superior drilling technology. During the course of first round talks, representatives of Bauma AG have shown a particular interest in Schneider GmbH & Co. KG. Bauma AG is large manufacturer of construction machines and devices. The company has grown during past years by acquiring smaller technology-based construction companies. Given the recent developments in the infrastructure sector as reflected by the extension of the glass fiber cables network in telecommunication or the increased use of natural gas for the heating of buildings, Bauma Management expects an accelerated increase in the demand of subsurface pipe laying.

Bauma AG starts its due diligence. Given the importance the Schneider patent portfolio the main focus of the due diligence is on that asset. Bauma Management believes that the patent portfolio contributes significantly to the overall value of Schneider GmbH & Co. KG. Hence, the monetary value of the patent portfolio shall be determined prior to entering negotiations, serving as a measure to determining the upper bound of the purchase price. Given the importance of the patent portfolio the patent valuation shall be performed according to established valuation principles and guidelines. The Management of Bauma AG requests that the Head of IP Management, Mr. Queue, gains full access to the relevant information and people at Schneider GmbH & Co. KG.

Mr. Queue is also advised by Bauma Management

- the relevant cost of capital is 12.0%,

- the product life cycle is at the beginning, and given the non-action of competitors to develop substitutes legal protection is six years,

- the company tax rate is 28.8%,

- the closing will not be prior to the end of 2008,

- first production of HDM will be early 2009,

- the valuation date is 1 January 2009.

In addition to the patent valuation the full market potential of the HDM shall be estimated that can be achieved by using Bauma AG’s distribution network. Based on the strong demand of trenchless pipe laying processes, the company’s market access and strong reputation the strategic controlling concludes on the following: …

Case study presentations:

Task 1:

Please describe the relationship between IP strategy and IP valuation:

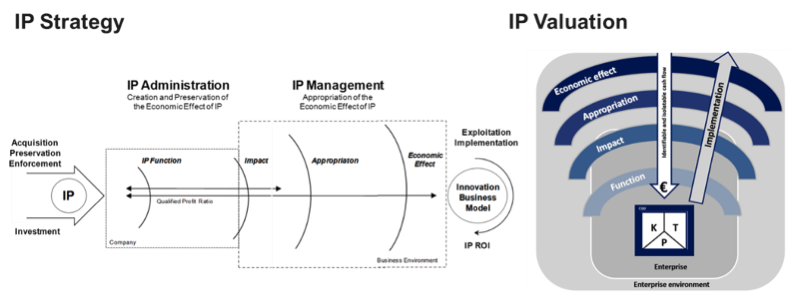

The value added from IP is subject as well to IP strategy development as to IP valuation. Because of this similarity, equivalent models of explanation and analysis can be used.

However, there are clear differences between the development of IP strategies and the valuation of IP.

- 1:

Please explain the major differences between IP strategy and IP valuation.

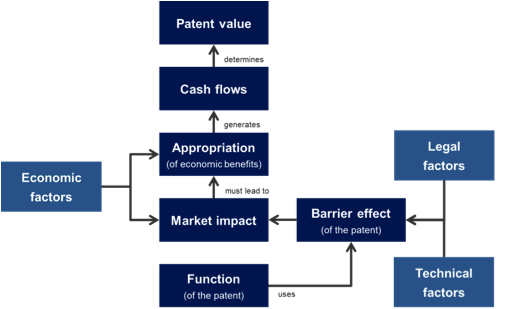

A common way of analyzing the value added by IP in a business model starts from the IP function and tends to determine the economic effect that the IP to be valuated achieves through a suitable exploitation process. For example, the following figure is taken from the German DIN standard “Principles of Proper Patent Valuation”.

A common way of analyzing the value added by IP in a business model starts from the IP function and tends to determine the economic effect that the IP to be valuated achieves through a suitable exploitation process. For example, the following figure is taken from the German DIN standard “Principles of Proper Patent Valuation”.

- 2:

Please explain how the value contribution of patents can be analyzed

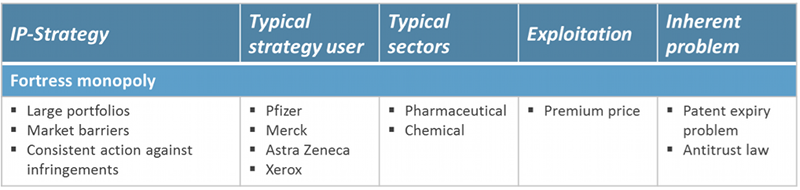

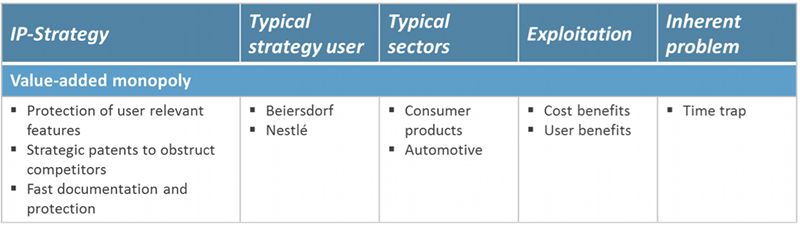

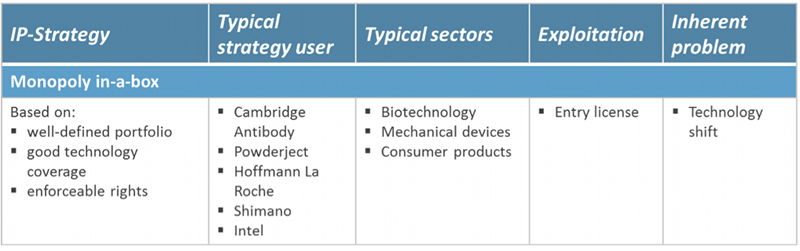

Christopher G. Pike formulates four generic IP strategy approaches (fortress monopoly, value-added monopoly, hob monopoly and monopoly-in-a-box). The way IP generates value within these strategic approaches is significantly different. In each of these strategic approaches, please show the typical type of value generation by means of an example.

- 3:

Please describe the IP-based value generation in a fortress monopoly based on the example of pharmaceuticals

- Which function do the patents fulfill in the case of pharmaceuticals?

- Which impact is caused by means of IP?

- How are the returns appropriated?

- Which economic effect that is generated?

- 4:

Please describe the IP-based value generation in a value-added monopoly based on the example of individualized functional yogurt

- Which function do the patents fulfill in the case of individualized functional yogurt?

- Which impact is caused by means of IP?

- How are the returns appropriated?

- Which economic effect that is generated?

- 5:

Please describe the IP-based value generation in a hub monopoly based on the example of telecommunication standards

- Which function do the patents fulfill in the case of telecommunication standards?

- Which impact is caused by means of IP?

- How are the returns appropriated?

- Which economic effect that is generated?

- 6:

Please describe the IP-based value generation in a monopoly in-a-box based on the example of Shimano

- Which function do the patents fulfill in the case of Shimano?

- Which impact is caused by means of IP?

- How are the returns appropriated?

- Which economic effect that is generated?

Here you can follow the presentation to task 1:

Task 2:

Please analyze the valuation context and the structure of the valuation model in the given case.

- 1: Please explain the prerequisites of IP value creation.

- 2: Please sum up the case study in brief words then analyze the valuation context of the given case.

- 3: Please analyze the valuation subject matter.

- 4: Please describe the decision Bauma has to take in the specific case and choose a suitable valuation method.

- 5: Please describe the objectification requirements and the source of the information to be considered.

- 6: Please summarize the results of the analyzes carried out.

Here you can follow the presentation to task 2:

Task 3:

- 1: Valuation formula

Please sum up the case study content in very brief words. The “Relief from Royalty Method” should be used for the patent valuation. Please explain the valuation formula and which parameters have to be determined to assess the patent value. - 2: Useful life

The duration of the valuation is limited to the patent portfolio’s useful life. Please assess the patent portfolio’s useful life for the case on hand. - 3: Relevant sales

Royalty rates are usually not applied to the total sales achieved by a product but to the share of sales that is attributable to the protected technical part. Please assess the reference parameter(s) for the case on hand. - 4: Modeling of royalty rates

Comparative license rates are typically used to determine an appropriate royalty rate. However royalty rate comparables cannot directly be transferred to the valuation situation. Comparable royalty rates and transactions have to be interpreted and modelled. - 5: Asset specific risk

Asset specific risks (in particular risks resulting from patent law) have to be reflected in the valuation. Please assess the asset specific risk for the case on hand. - 6: Value calculation

Please explain the calculation of the patent value using the relief from royalty method.

Here you can follow the presentation to task 3: