Start of the Certified university Course „IP Valuation (II)“

With the increasing digitalization and dematerialization of the economy, also the value of the so called intangible assets becomes more important for decision makers. The intangible assets comprise every company asset, with cannot be touched and is non-financial, e.g. human capital, know-how or intellectual property rights. It is now more crucial than ever to understand the value of those intangible assets in their company to keep a business successful in the 21st century. The Certified University Course on “IP Valuation (II)” at CEIPI offers here the opportunity to learn, how to valuate assets, from patents and brands to intellectual capital as a whole.

The clearest examples for the relevance of intangibles and IP for the value of a company are brands. Even in our daily buying behavior, when we are shopping in the supermarket, they are influencing our decisions and result in a preference for branded products. This creates an economic value for the brand owning company.

The clearest examples for the relevance of intangibles and IP for the value of a company are brands. Even in our daily buying behavior, when we are shopping in the supermarket, they are influencing our decisions and result in a preference for branded products. This creates an economic value for the brand owning company.

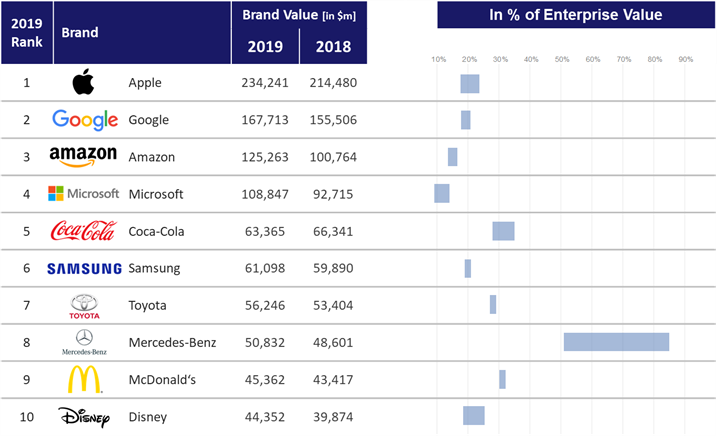

This can be seen e.g. for the top 10 most valuable brands where the relative share of the brand value is compared to the enterprise value. Here, the brands create value by their brand identity, which describes what the companies are doing and what they are known for. So, for example the Google brand is well known for its search engine, but the company earns more and more money with google adds, YouTube, the Android smartphones and increasingly with AI applications. Microsoft on the other hand is known for its Windows operating system and software such as Word, Excel and PowerPoint, but has turned into a technology company. Also, IBM started as a hardware company selling computers and has turned into a technology consultant and service provider. So, a brand has an own and independent personality and can be used by a company in multiple business models to promote different products and services. Not least because of this, the brand is one of the most valuable assets for many companies.

Cannot open the video? Please click: https://youtu.be/OYjt5ibr89Q

The valuation of intangible assets is about the determination of the private-economic value of the intangible asset, for example IP, which is the ability to obtain a future economic benefit from its use. For the determination of the value of intangible assets, the measurement of the economic effect of intangible assets like IP can be performed either directly or indirectly. The direct observation is based on observable transactions of IP and the associated prices. The indirect observation is in contrast based on the analysis of the so-called market to book value gap.

Since a direct observation of the value of intangibles such as intellectual capital or IP is not possible, one determines the value of IP indirectly based on the observation of the so-called market value to book value gap. The market value is given by the market capitalization of the enterprise, for example, the current market value of the shares multiplied by their number. The book value corresponds to the value of the assets in accordance with the balance of the enterprise. For a long time, a substantial difference between the observable market value and the book value relating to the balance has been determined.

The starting point of any IP valuation is the object of valuation or the valuation subject matter. In the case of IP portfolios, the naïve answer would be that this object of valuation is just the IP portfolio, but an isolated piece of IP has no economic value in itself. In contrast, for the valuation the valuator must always model a decision situation for the concrete use of IP. In this valuation model, the valuator has to answer the question, what is the economic role of the valuated IP portfolio and what is the future economic benefit of the ownership. So, the value of the IP portfolio can only be answered via an adequate modeling of the valuation situation and the associated subject matter, the IP portfolio.

The task for the valuator is to develop an adequate model of the real valuation situation, which describes how the value of the IP portfolio arises from the concrete usage scenario. The valuation subject matter is therefore not an isolated object, but always seen in one concrete or even multiple concrete utilizations.